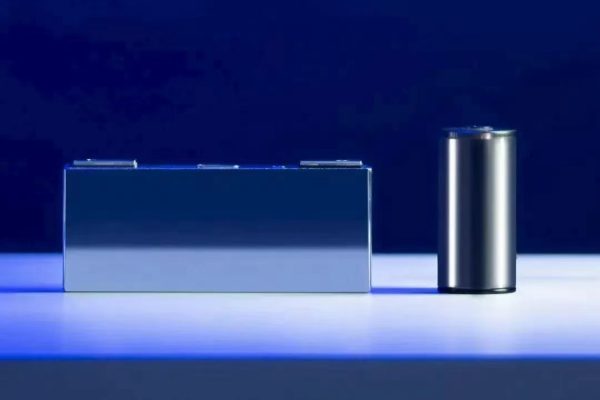

LFP Moving from Niche to Mainstream

Lithium Iron Phosphate (LFP) has evolved from being a niche chemistry to a dominant force in global energy storage trade. Known for its safety, long cycle life, and cost stability, LFP is increasingly favored by international buyers over other chemistries like NMC. For exporters, understanding the long-term prospects of LFP is critical to building sustainable business strategies.

1. Safety as a Long-Term Differentiator

- Thermal stability: LFP’s superior safety performance reduces fire risks, a critical factor in residential and commercial storage.

- Global regulations: Stricter international safety requirements align naturally with LFP’s properties.

Outlook: As safety standards tighten, LFP’s role as a trusted chemistry will only grow stronger.

2. Cost Predictability and Material Security

- Abundant raw materials: LFP uses iron and phosphate, which are less volatile compared to nickel and cobalt.

- Stable pricing: This reduces risks for both suppliers and buyers in long-term contracts.

Outlook: In an industry sensitive to commodity swings, LFP ensures cost competitiveness for exporters.

3. Cycle Life and Warranty Alignment

- Long cycle life: 4,000–6,000+ cycles at 80% DOD, aligning well with 10–15 year warranties.

- Buyer trust: Extended durability supports ROI-driven decisions, especially in premium markets.

Outlook: As buyers demand longer warranties, LFP will remain the chemistry of choice.

4. Regional Adoption Trends

- Europe: Strong preference for LFP due to safety and sustainability requirements.

- US: Rapid shift from NMC to LFP in both residential and commercial storage.

- Middle East & Africa: LFP favored for high-temperature resilience.

- Asia-Pacific: China leads global LFP production and deployment.

Outlook: LFP is on track to become the standard chemistry for most stationary storage markets.

5. Technological Improvements

- Energy density gains: Ongoing R&D is narrowing the gap with NMC.

- Module and system design: Innovations in pack engineering enhance performance without sacrificing safety.

Outlook: As technology improves, LFP will become even more competitive in applications previously dominated by NMC.

6. Implications for Exporters

- Market positioning: Highlight safety, durability, and cost predictability in quotations.

- Portfolio strategy: Offer LFP as the mainstream solution, while keeping NMC options for niche high-density needs.

- Long-term partnerships: LFP’s reliability makes it a cornerstone for stable, recurring business.

LFP as the Future Backbone of Storage Trade

The long-term prospects of LFP in global storage trade are exceptionally strong. As buyers prioritize safety, cost stability, and longevity, LFP stands out as the chemistry best aligned with these trends. For exporters, building expertise and credibility around LFP will ensure access to premium markets and secure long-term growth.