Energy Storage Trends 2025: Global Technology, Policy, Market Outlook

Introduction

As the global push toward renewable energy intensifies, energy storage systems (ESS) have become critical to enabling a stable, low-carbon power grid. Whether stabilizing solar and wind intermittency or supporting off-grid applications, storage solutions are shaping the future of energy infrastructure. In 2025, advancements in battery technology, strong government support, and market dynamics are converging to define the next chapter in this fast-growing sector.

1. Technology Spotlight: Innovations Reshaping the Energy Storage Landscape

✅ Solid-State Batteries Gain Momentum

Solid-state batteries, once viewed as a distant innovation, are now approaching commercial readiness. With higher energy density, better thermal stability, and longer life cycles compared to lithium-ion batteries, they are attracting attention for both utility-scale and residential storage applications. Companies such as QuantumScape and Toyota are investing heavily in this field, signaling a shift in battery architecture.

✅ Rise of Liquid-Cooled ESS

Thermal management has emerged as a critical concern, especially for large-scale installations. Liquid-cooled battery energy storage systems (BESS) offer improved heat dissipation, energy efficiency, and lifespan. They also enhance safety in high-temperature regions like the Middle East, Southeast Asia, and parts of the U.S., making them increasingly popular in global tenders.

✅ Intelligent Control & Remote Management

The integration of AI, IoT, and edge computing into storage systems has transformed them from passive batteries into intelligent energy hubs. Smart ESS platforms can now monitor cell-level performance, predict failures, and optimize charge/discharge cycles in real time. This capability is especially valuable for distributed energy resources (DERs) and hybrid systems combining PV + storage + EV charging.

2. Policy Landscape: Global Governments Double Down

🇪🇺 Europe: Incentives + Regulation

The European Union continues to lead with ambitious targets under its Green Deal. In Germany, the KfW 442 subsidy scheme offers attractive financial support for homeowners installing battery storage with PV systems. Meanwhile, the EU’s Battery Regulation (effective 2024) enforces sustainability standards, including carbon footprint declarations and recycling targets.

🇺🇸 United States: Tax Credits and Utility Mandates

The Inflation Reduction Act (IRA) offers a 30% Investment Tax Credit (ITC) for standalone storage, igniting a surge in utility-scale projects. States like California and New York are enforcing minimum storage mandates, pushing for gigawatt-level deployments by 2030. FERC 2222 has also opened doors for distributed storage to participate in wholesale energy markets.

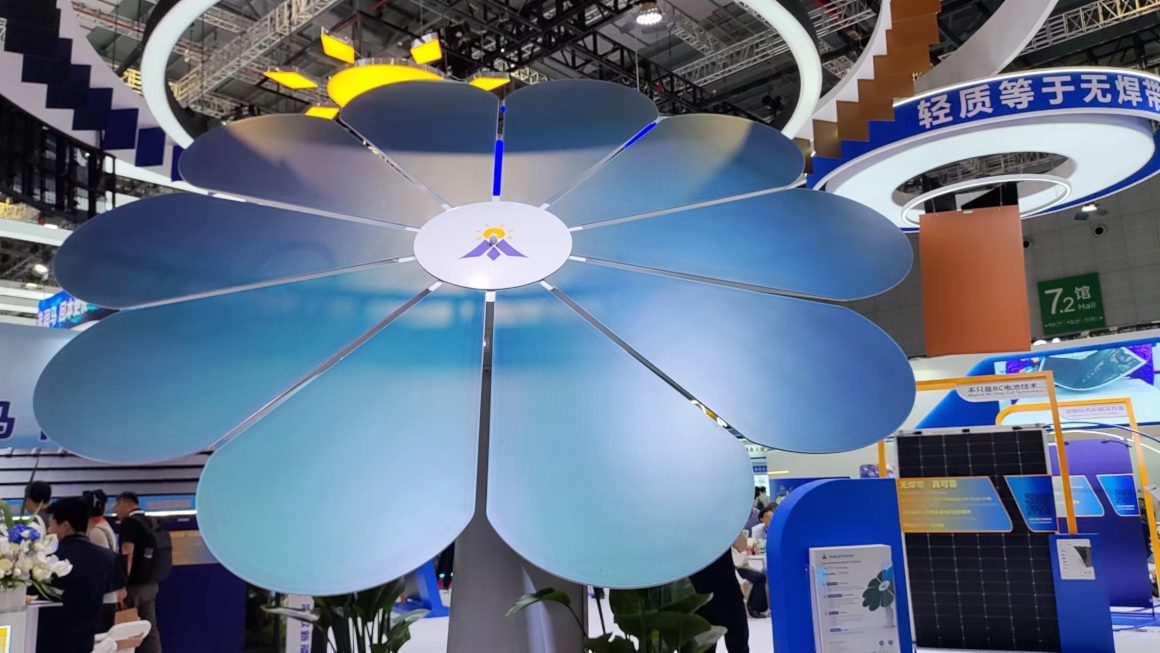

🌏 Asia: China and Emerging Markets

China remains the global leader in both storage manufacturing and deployment. The National Development and Reform Commission (NDRC) mandates that new solar/wind projects incorporate storage, typically 10–20% capacity for at least 2 hours. In Southeast Asia, Thailand and the Philippines are launching storage-friendly policies to improve grid resilience and renewables integration.

3. Market Growth and Key Players

📈 Market Scale and Segments

According to BloombergNEF, the global energy storage market is expected to reach 500+ GWh of installed capacity by 2030, with 2025 poised as an inflection point. Growth is strongest in:

- Utility-scale storage: Grid balancing, frequency regulation, peak shaving

- Residential ESS: Driven by high electricity rates and prosumer behavior

- Commercial & Industrial (C&I): Supporting critical facilities and demand charge reduction

🔍 Leading Companies

Key players dominating the space include:

- Tesla Energy: Powerwall and Megapack expansion

- CATL & BYD: Gigafactory scaling and technology licensing

- Sungrow & Huawei: Inverter-integrated storage for global markets

- Startups: ESS Inc., Ambri (liquid metal), Form Energy (iron-air)

4. Challenges and Strategic Opportunities

⚠️ Safety, Supply Chains, and Standards

- Fire risk in lithium-ion systems remains a major concern; rigorous safety certifications (e.g., UL 9540A) are increasingly mandated.

- Raw materials like lithium, cobalt, and nickel face geopolitical and supply chain volatility.

- Standardization across battery form factors and communication protocols is still evolving, hampering interoperability.

✅ Strategic Opportunities

- Second-life batteries from EVs present a circular economy advantage for residential and rural applications.

- Hybrid systems combining storage with solar PV and EV chargers are gaining interest in smart home and microgrid design.

- Energy-as-a-Service (EaaS) models are unlocking adoption without upfront capital, especially in emerging economies.

Conclusion

The global energy storage industry in 2025 is marked by rapid innovation, supportive policy, and commercial traction. For solution providers like GR New Energy, this environment offers a rare window to lead in both industrial and residential segments. By aligning technology development with evolving regulatory frameworks and market needs, companies can unlock sustainable growth while accelerating the clean energy transition.